Before trading, please ensure that you fully understand the risks involved

Much of the world was preparing to celebrate New Year’s Eve 2019, when a Chinese government website warned of the existence of “pneumonia of unknown cause” that was bringing death and mayhem to the city of Wuhan. Nobody must have imagined then that 100 days later, this virus termed Covid-19 would have infected nearly 1.5 million people and claimed over 85000 lives, confined more than 50% of world population to their homes, halted international travel and extinguished economic activity.

The virus has not only created havoc in the daily life but also led to turmoil in all the financial markets. When the news of the virus first broke out, it didn’t seem to have any impact on the stock markets with Wallstreet indices creating new highs. However, as the virus spread outside China particularly in Iran Italy and South Korea, financial stock markets across the world started to feel the pain.

Impact on Stock Markets

As the virus spread across the Eurozone and the US, equity indices witnessed a free fall with SPX 500 sliding over 30% from the highs. Among the worst hit were Eurozone indices with Spain (IBEX), France (CAC40), and Germany (DAX 30) with all losing almost 39% at one point in time from the 2020 highs. Likewise, India’s Nifty index, UK’s FTSE and Australia ASX 200 all witnessed losses in excess of 35% from their respective highs this year.

With oil income contributing to over 70% of the public revenues, major GCC bourses also suffered massive losses. Saudi Arabia’s Tadawul index lost 30% from this year’s high at one point. ADX and DFM also lost in excess of 35% from the highs this year impacted by drop in tourism as well as oil prices.

Stocks related to the travel and tourism sector and the leisure industry particularly the airlines, cruise, casino and hotel stocks were hit the hardest. To name a few United airlines stock lost 73% this year, Carnival Corp has shed a whopping 78% while Wynn resorts has lost nearly 60% YTD.

The sectors which have outperformed during this volatile environment are primarily Pharma and Consumer staples. Select pharma stocks that are working on finding a cure to COVID-19 or supply masks and gloves and other instruments which aid in fighting COVID-19 have seen their share price soar this year. Novavax which already boasts success in vaccine development for the MERS and SARS strains and is developing a vaccine for this respiratory disease has seen its stock price surged a massive +300% this year while Moderna Inc, the first company to ship coronavirus vaccine for human testing to the NIAID has rallied almost 65% YTD.

Tealdoc Inc, the worldwide leader in virtual care which allow healthcare professionals to provide medical consultations via videoconferencing has recorded a YTD gain of over 65%. Clorox, the company which sells disinfectant wipes and other household cleaning products saw its stocks climb 17% YTD. Besides, stocks which aid Work from home like zoom video and slack technology also witnessed a robust rally. Zoom video communications which provides a remote conferencing service that combines video conferencing, online meetings, chat, and mobile collaboration saw its stock price climb by 80% YTD.

Impact on Commodities

Among the commodities, crude oil suffered the most impacted by the double whammy effect of increased oil supply as well as lower oil demand. Oil prices tumbled by more than 70% at one point in time as Saudi Arabia and Russia entered into a price war at a time when global oil demand is expected to drop by at least 25 %.

Current oil price slump has created a massive contango in the oil markets with current spread between Brent cash prices & Brent September contract at record $ 10 - $ 11 range, level seen during last Global financial crisis.

With the halt in economic activity, industrial metals, like platinum, copper, iron, also witnessed losses and are trading 23%, 19% and 13% lower respectively on YTD basis. Palladium, highly used in the automobile industry, is also trading 24% lower from the highs this year. The metal which breached the level of $2850 this year dipped to as low as $1484 at one point as the pandemic dented the automobile demand.

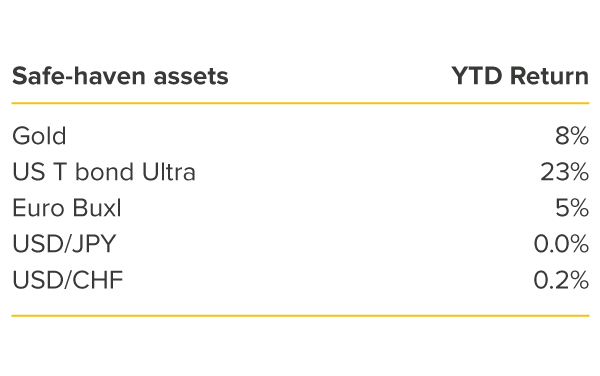

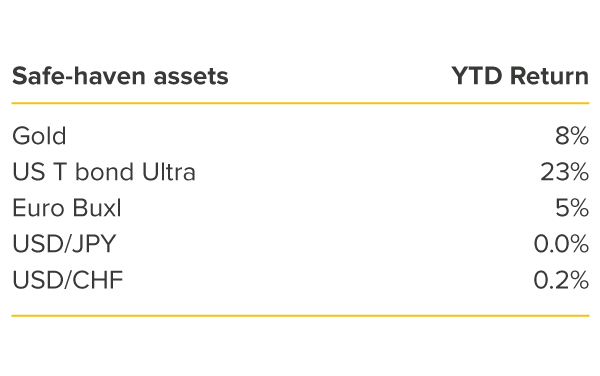

Impact on Safe-haven Assets and Currencies

The star performer among the commodities was gold which recorded a high of $1703 as fear of recession gripped the investors. The safe-haven metal which is often sought in times of crisis is trading 8% higher for the year. Apart from the oil contango another major shock to the market, was the spread between the gold spot and futures contract. At one point in time, the futures contract was trading $90 above the spot contract on concerns whether there will be enough gold available in New York to deliver against futures contracts traded on the Comex in the city.

Besides, as recession fears rose, so did the demand for Treasury bonds. US Treasury Ultra bond witnessed a robust YTD rally of 23% while Euro BUXL rallied by 5% YTD. In the currency market, US Dollar was the king as the need to hold cash and the massive liquidity crunch saw the Dollar Index climb to almost $103 mark before settling around $100 level. For the year, the Dollar index which tracks the Greenback against a basket of other currencies is trading almost 4% high this year.

Measures announced by Governments & central Banks to counter the impact of global slowdown

Massive stimulus measures from the governments and monetary support from the Central banks came to the rescue of the reeling markets. With G20 economies announcing plans of injecting more than $5 trillion into the global economy over and above the unprecedented fiscal stimulus and monetary measures from major Central Banks, equity markets have recovered part of their losses. Major indices have rallied by over 15% from their lows despite all the doom and gloom related to the economic fallout of Covid-19 outbreak. Hopes that the cases have peaked in the Eurozone and are nearing their peak in the US also supported the rally. However, this is expected to be short lived as investors realize that any turnaround in infection rates isn’t going to be a one-way street. Besides Bear markets are often characterized by sharp rallies. If a cure is found soon, the rally will continue. However, in the absence of a cure, there is a high probability that the rally will fail especially when corporates earnings will be slammed, and the guidance will be uncertain. The moot question is whether the recovery in the markets will be a V-shaped or W-shaped. Given the experience of 2008, and the long time required for normalization as well as customer reengagement; it seems that the recovery in financial markets will be W shaped.

"}

"} "}

"}