Before trading, please ensure that you fully understand the risks involved

Monday, May 27, 2019

Khaleej Times – Modi’s win to power Indian rupee, but may retreat in late-2019

Currency set to gain strength in post-election trade, but may shed some value in late-2019.

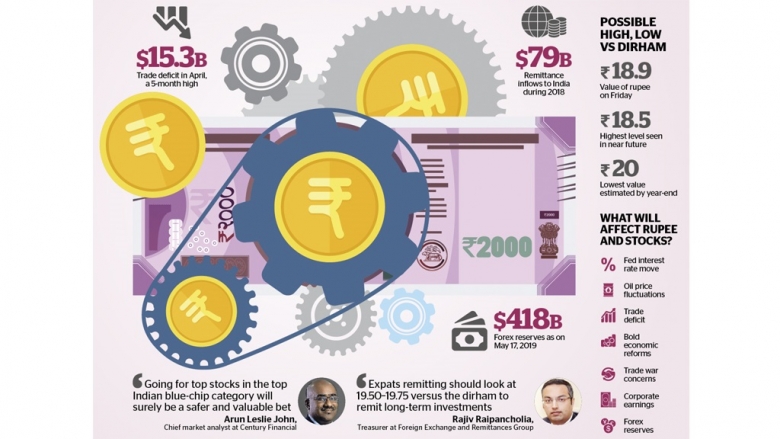

The Indian rupee is seen to strengthen in the near future due to increased foreign funds inflow expected, following the massive victory of the BJP party in the elections, but analysts expect that the currency could touch 20 versus the UAE dirham by the end of 2019 due to a trade deficit, poor earnings and other global concerns.

Analysts expect the rupee to trade between 18.50 to 19.75 against the dirham during the remainder of the year with interest rate moves from the Reserve Bank of India and US Federal Reserve, global trade war concerns and oil prices seen to dictate the Indian currency and equity markets.

The rupee hit 20.20 against the dirham last October but has recovered since and is currently trading near 18.90 levels. Most of these gains are attributable to sharp inflows that Indian stock markets received this year, as well the unexpected RBI rate cuts.

Rajiv Raipancholia, treasurer at Foreign Exchange and Remittances Group and CEO of Orient Exchange, sees the rupee appreciating in the next couple of weeks. But looking at the fundamentals, depreciation is expected by year-end.

“We can look at the rupee touching 20 per dirham by year-end,” he added.

He said an increasing trade deficit, a slowdown in foreign institutional investor inflow, poor corporate earnings and increased crude prices are some of the factors that will depress the currency in the coming months.

“Interest rates are still high for deposits at around 7 per cent. Indian expatriates remitting funds back home should look at 19.50-19.75 versus the dirham to remit long-term investments, which would be a reasonably good rate,” Raipancholia said, adding that remittances grow between 4 to 8 per cent before and during Eid.

Per World Bank figures, around $79 billion remittances were sent to India in 2018. India’s foreign reserves, meanwhile, fell $2 billion to $418 billion last week.

Antony Jos, executive director at Joyalukkas Exchange, noted that the Indian currency could get stronger temporarily as the election results are out.

“Narendra Modi stormed to a second term with a record mandate. But there are other global economic factors that also influence the Indian rupee, like a trade account deficit, Fed rates, oil price, Brexit and the trade war tensions,” said Jos.

Promoth Manghat, group CEO at Finablr, said the electoral win of Modi will significantly enhance investor confidence and should reflect in gains for the rupee.

“The resounding mandate points to a stable government, which will be able to ensure continuance of ongoing reform measures and unhindered policy decisions,” Manghat said.

“The pair is well-supported near 18.50 levels,” he added.

Indian stocks

With the euphoria around the Indian elections coming to an end, NRIs are advised to cherry-pick and look for value-based stocks of companies that have sound fundamentals and are a good value pick.

His best picks are ITC, L&T, Infosys, Asian Paints, Reliance Industries, Mahindra & Mahindra, HDFC and Sun Pharmaceuticals.

He noted that after successfully passing major bills like the Goods and Services Tax and announcing drastic measures like demonetisation, markets are increasingly betting on the fact that with absolute the majority on hand, chances of further bold and meaningful reforms are likely more than ever.

Source:

"}

"} "}

"}